1xbet Türkiye Casino İncelemesi Bilgilendirici Ve Yardımcı” 1xbet Türkiye & Giriş 2022 + Mobil Bahis Content Oyun Seçenekleri Neden 1xbet Türki̇ye Spor Bahi̇sleri̇ Ayın Premier Bonus Lezzetleri ‘ye Kadar 100% Bonus Kazanin Bonus Ve Promosyonlar” Ödeme Yöntemleri Bet Giriş Spor Bahislerinde Devrim Niteliğindeki 1xbet Türkiye Bet Ödeme İşlemleri: Para Yatırma Ve Para Çekme Mobil Bonuslar Bet Giris Online Casino Karşılama Bonusu Bet’yi Daha Fazla Bahisçiyle Karşılaştırın Bahisçi Lisansı Hakkında Bilgi Para Yatırmak Ve Çekmek Için Hangi Ödeme Yöntemleri Mevcuttur? Bet Canlı Bahis Çalışma Prensibi Bet Türkiye Yeni Giriş Adresi Bet Hakkında Sıkça Sorulan Sorular 2024 Spor Bahsi Ürünleri Güvenilir Destek Parmaklarınızın Ucunda Bet Slot Turnuvaları 2024 Futbol Bahisleri Kredi Kartı […]

Between 22 and 26 January, the Italian bank purchased 4,678,776 treasury shares, at a weighted average price of 26.5864 euros, for a total turnover of over 124 million euros.The purchases took place as part of the first tranche of the 2023 buy-back programme launched on 30 October, in implementation of the authorisation granted by the Shareholders’ Meeting of 27 October 2023.On 26 January 2024, unicredit held 11,575,072 treasury shares equal to 0.68% of the share capital.For the first tranche of the Programme for the repurchase of own shares 2023, Unicredit provides for a maximum amount of € 2.5 billion for a number of shares not exceeding 160,000,000. Unicredit’s total distribution […]

At the end of October, the European Central Bank (ECB) suspended the rate hike after 10 consecutive increases, which started in July 2022. The economist Osama Rizvi explains to Euronews Business what are the prospects for interest rates. The next ECB meeting will take place on 14 December 2023, and analysts predict that the European Central Bank will lower interest rates, but last time it kept them at 4 %. Rising interest rates have a negative impact on consumers, as mortgages and interest on other loans become very expensive. In addition, the increase in costs for businesses (now that interest rates are high) affects consumers, who pay more for consumer […]

New rates for tax credits reserved for companies that increase wages. Announced the review of tax benefits for foreign tourists.

DEFINITION: Taxes are mandatory contributions paid in cash by individuals or corporations and they’re levied by a government entity, if somebody don’t respect the payment of taxes, it’s tax evasion and is punishable by law. Taxes are the primary source of revenue for most of the government and as a result it’s very important that only citizen pay it, because they’re useful to finance government activities, including public works or services like roads, schools, public means of transport, hospital, pay the salary of public workers… , so they’re necessary for the betterment of the economy and all who living in the country. In the United States and many other countries […]

Let’s see what the best workplaces of 2023 are, in relation to the rise of employees and incomes, the trust and the merit.

The collapse of Silicon Valley Bank has caused ripple effects around the world. Let’s see what happened.

Italy introduces measures impacting non-Italian resident investors, including taxes on capital gains from the sale of unlisted shares in certain entities

Italy introduced a new Investment Management Exemption (IME). Who can benefit from it?

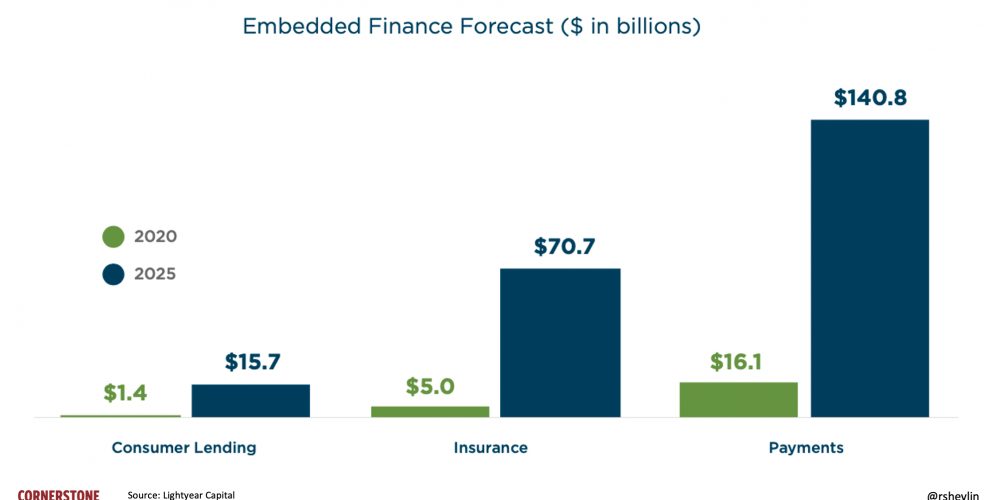

Embedded finance is gaining more and more popularity among not financial companies because it allows them to incorporate inside them original financial solution, like e-commerce platforms’ new payment methods and it brings multiple benefits both to end users, who will be offered greater convenience, faster transactions and savings in time and effort, and to the companies that use it. This has been spreading since the enactment of the second European Payment Service Directive (PSD2), that made a new fundamental technology for open banking like API (application programming interface) develop and use possible. Thanks to this innovation, according to a study conducted by the British business Juniper Research called “Revolutionizing […]